Contra accounts can be used to register the inventory that has been damaged, goods returned by customers, equipment depreciation, etc. In tune with this, a contra-revenue account is used by companies to figure out the items sold and the ones that are not. Now, let’s start with how to set up a contra revenue account in QuickBooks. When these things are not accounted for, it creates a negative impact on the business.

What is a Contra Revenue Account?

Contra revenue refers to deductions made from the gross revenue reported by a business. This results in net revenue. In simple words, a contra revenue account should have a balance that is the opposite of a usual credit balance in a particular revenue account. A contra revenue account empowers a business to determine the exact amount sold, along with the products that reduced the sales significantly, to the net sales amount.

Here are the two best examples of Contra Revenue Accounts:

- Sales Discounts

- Allowances and Sales Returns

Along with these, examples of a contra-revenue account also include sales allowances. As a business owner, you should always debit the contra revenue account, and the corresponding revenue accounts should be credited.

Key Takeaways

- Contra accounts are used to record reductions to main accounts such as assets, liabilities, equity, and revenue.

- Recording these reductions separately allows you to display both gross and net amounts on financial statements, improving clarity and transparency.

- They help ensure compliance with core accounting principles like the matching principle and historical cost concept.

- Monitoring trends in contra accounts provides valuable insights for strategic decision-making, including managing inventory, setting prices, and extending credit.

Read More: How to Set Up Direct Deposit in QuickBooks

Steps to Set Up a Contra Revenue Account in QuickBooks

Here is how you can easily set up a Contra Revenue account in QBO.

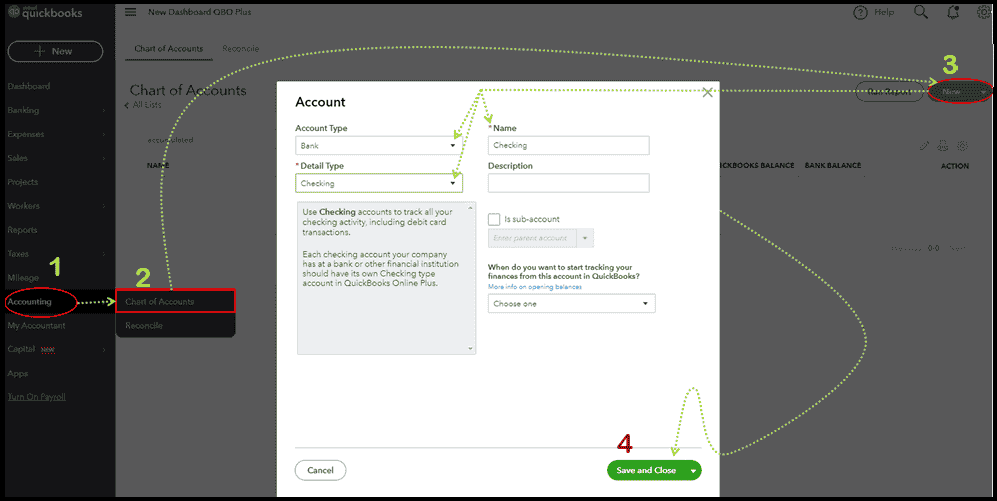

- In your QuickBooks account, click the Accounting option on the left side of the pane.

- Choose Chart of Accounts

- Select Newly visible on the upper right side

- Choose the Accounting type, Name, and Detail type of the account

- Select Save and Close

Setting up a contra revenue account for a business is crucial to keeping the book of accounts accurate and dispute-free. Hence, it is highly recommended that every business owner should do it at the earliest. If you get stuck while adhering to the above-mentioned steps, it is highly recommended to talk to an expert in the field.

Conclusion

Setting up a contra revenue account in QuickBooks helps you maintain accurate, transparent financial reporting by clearly showing the difference between gross and net revenue. Whether you manage sales discounts, product returns, or allowances, using a dedicated contra revenue account ensures proper bookkeeping and reliable insights. If you need help configuring or managing contra revenue accounts in QuickBooks Desktop or Online, the experts at BigXperts can guide you through setup, customization, and reporting for flawless accounting accuracy.

Frequently Asked Questions

What is a contra revenue account in QuickBooks?

A contra revenue account is used to record deductions from gross revenue, such as sales discounts, returns, or allowances. It helps in accurately displaying net revenue on financial reports by offsetting total income.

Why should I create a contra revenue account in QuickBooks?

Creating a contra revenue account provides clearer financial reporting by distinguishing between total sales and deductions. It’s especially useful for businesses that regularly issue refunds or discounts.

How do I set up a contra revenue account in QuickBooks Desktop?

Go to Lists → Chart of Accounts → Account → New → Income Account, then name it something like “Sales Returns and Allowances.” Check the option to make it a sub-account under your main sales account.

Can I use contra revenue accounts in QuickBooks Online?

Yes, in QuickBooks Online, create a new income account and assign it a negative value when recording returns or discounts. This will automatically offset total sales in reports.

How do contra revenue accounts affect financial statements?

Contra revenue accounts reduce total revenue in your Profit and Loss statement, helping present a more accurate view of net income by reflecting all deductions from gross sales.

Can I track multiple contra revenue types separately?

Absolutely, you can create multiple contra revenue accounts, such as Sales Returns, Discounts Allowed, or Refunds Issued, to get detailed insights into revenue adjustments.

What’s the best practice for maintaining contra revenue accounts?

Regularly reconcile these accounts, review adjustments monthly, and ensure that each return or discount is recorded under the correct contra revenue type for transparent reporting.

Speak to A Specialist about QuickBooks Software

Headache🥺. Huh, Save time & money with QuickBooks Support 24×7 @ +1-800-892-1352, we provide assistance to those who face problems while using QuickBooks (Support all U.S. & Canada Editions)

--- Support - We provide solutions for the following QuickBooks (Pro, Premier, Accountant, Enterprise, Payroll, Cloud) ---

- Error Support

- Data Import

- Data Conversion

- Payment Solutions

- Upgradation

- Payroll Support

- Data Export

- Software Integration

- QuickBooks Printer Support

- Complete QuickBooks Solutions

- Tax-Related Issues

- Data Damage Recovery

- Installation, Activation Help

- QuickBooks Windows Support

1-800-892-1352

1-800-892-1352 Chat Now

Chat Now Schedule a Meeting

Schedule a Meeting